Which markets do you operate in?

We’re a multi-lingual team with partnerships on several continents around the world, so we’re able to expand from the current base of 21 countries to many, many more, depending on your requirements.

1

QUANTITATIVE STUDIES

UK, USA, Australia

Spain, France, Germany, Italy, Poland, Netherlands, Belgium, Czech Rep, Nordics, Turkey

South Africa, Morocco, India, UAE

Brazil, Argentina, Mexico

Japan, China

2

QUALITATIVE STUDIES

UK, USA, Australia

Spain, France, Germany, Italy, Poland, Netherlands, Belgium, Nordics

South Africa, Morocco, UAE

Brazil, Chile

Japan

3

REMOTE USER TESTING

UK, USA, Australia

Spain, France, Germany, Italy, Poland, Netherlands, Belgium, Nordics

Which clients have you worked with?

We work with clients across multiple sectors. Some clients commission us to fully integrate our resources with theirs, as interim support staff on client premises; other clients commission us on ‘single stage’ projects, typically research; and others on ‘multiple stage’, end-to-end projects which incorporate Research, Strategy, Performance plus Training to embed new skills with which to implement change.

1

Toys, Entertainment, Games, Apps

Many of these clients seek our expertise in the kids sector, as highly experienced and accomplished researchers with children and having worked client-side in licensing too.

2

Food, Drinks, FMCG Grocery

From highly perishable goods to processed and less frequent consumables, ambient, frozen, fresh and chilled, we tackle your challenges fully appreciating JIT supply.

3

Food & Drinks Service (OOH)

Originates from our extensive experience with Costa Coffee and on-trade drinks suppliers such as Diageo, Matthew Clarke Gaymers.

Tell me more about the Consumer Fluent Client Portal

All clients are given a login to the portal, which takes them directly into a secure online sharepoint. That space is an exclusive area, only accessible by their assigned users and Consumer Fluent’s administrator and assigned consultant.

In that space they can view their continuous tracker dashboard, research documents, multi-media material, insights, and training courses they have subscribed to. They can also view forums and timelines of their consumer community, if they have one. Users can edit, collaborate, customise and share the folders or documents in their account area.

Trackers & Dashboards

Qual & Quant Research

Community & Forums

Training Courses

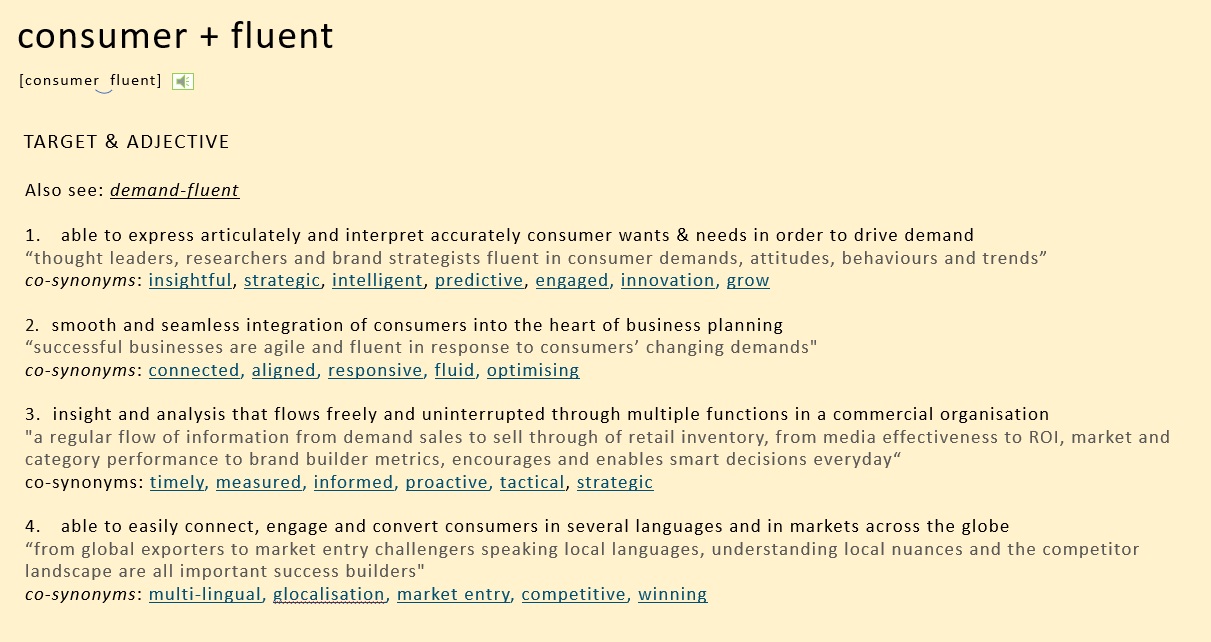

Why are you called “Consumer Fluent”?

The best way to become fluent in a language is through seamless integration into the lives of other people, tuning into their words and intonations. Fluency in itself is a state of ease in articulate communication, the ability to exchange information, ideas, thoughts fluidly. To connect, engage and inspire.

1

CUSTOMERS

We could have chosen to call ourselves “Customer Fluent” because we absolutely do connect, engage and inspire retail customers. We speak their language as fluently as we speak yours.

2

DEMAND

We could have included the word ‘demand’ in our name because communication is more than words… it’s data and metrics, the outcome of your marketing investment, the levers you pull.

3

CONSUMERS

However demand depends on consumers. Customers rely on them too. There’s no getting away from the fact that all roads lead back – via brands, retailers and shoppers – to the consumer… .

Consumer Fluent founder

Ruth Clement

I’m an economics and languages graduate, and have lived, loved and learned in 3 countries in addition to the UK. Whenever I learn a new language I immerse myself, engage, respond and listen to people in order to get the inflexion and nuances, and embrace every opportunity to put into practice what I’ve just learned.

I owe my business success to a different type of fluency – consumer fluency – in knowing consumer and customer wants and needs. It’s all about bringing the consumer into the heart of business and, as a team, looking through that consumer’s lens.

We deepen our understanding and ability to influence consumers based on verbal and non verbal cues, actual behavioural analysis, which help us to identify decision drivers based on Systems 1 & 2. I practice Consumer Fluency as I would any language, bringing it to life in business strategy.